Explore web search results related to this domain and discover relevant information.

The Insurance Claims Counsel will be responsible for assisting the Insured Claims Group Leader with implementing and overseeing the Insured Claims Group’s processes and procedures related to DPR and DPR-related entity insured claims, in an effort to maintain consistency of process, flow of ...

The Insurance Claims Counsel will be responsible for assisting the Insured Claims Group Leader with implementing and overseeing the Insured Claims Group’s processes and procedures related to DPR and DPR-related entity insured claims, in an effort to maintain consistency of process, flow of information and to promote early resolution of claims aiming for the best outcomes for DPR.The Insurance Claims Counsel will also be responsible for assisting with claim strategy on large complex claims (including convening strategy discussions with stakeholders), as well as managing certain insured liability/damage claims, as assigned by the Insured Claims Group Leader.The role will also include responsibility for all aspects of complex Construction Defect and Property Damage (“CDPD”) incidents and claims for DPR and DPR-related entities, as assigned by the CD/PD Insured Claims Manager.Assure carriers are operating within carrier claim service agreement parameters · Key member of DPR Team that will collaboratively develop the necessary reports from RMIS system for various users/purposes · Work with Construction Techology team and Insurance Data Analysts to help enhance and streamline the RMIS system processes

File your Progressive insurance claim online, and find info on how the Progressive insurance claims process works for auto, property, motorcycle, & more.

Log in to your Progressive account to report or view an existing claim. Progressive policyholders without an account can also register for one here. ... If you are not insured by Progressive or are a Progressive customer without an account login, you can report or view an existing claim here.No matter which type of claim you have, our goal is to make sure everything goes smoothly.That means making your claims process as easy as possible and keeping you updated.Get a breakdown of the claims process, what to do, and where to go from here.

Learn what an insurance claim is, how the process works, and what to expect when filing a claim. Get expert insights on insurance claims with MetLife.

An insurance claim is a formal request from the policyholder to their insurance company asking for payment after a covered incident, such as a hospital stay, a natural disaster, theft, and more.In this article, we’ll discuss types of insurance claims, the general process of filing a claim, and help answer several FAQs on the topic.For specific claims information, be sure to refer to your policy or contact your insurer.There are as many insurance claim types as there are types of insurance.

After a disaster, you want to get back to normal as soon as possible, and your insurance company wants that too! You may get multiple checks from your insurer as you make temporary repairs, permanent repairs and replace damaged belongings. Here's what you need to know about claims payments.

The first check you get from your insurance company is often an advance against the total settlement amount, not the final payment. If you're offered an on-the-spot settlement, you can accept the check right away. Later, if you find other damage, you can reopen the claim and file for an additional amount.Some contractors may ask you to sign a "direction to pay" form that allows your insurance company to pay the firm directly. This form is a legal document, so you should read it carefully to be sure you are not also assigning your entire claim over to the contractor.Even if you have a replacement value policy, the first check you receive from your insurer will be based on the cash value of the items, which is the depreciated amount based on the age of the item. Why do insurance companies do this? It is to match the remaining claim payment to the exact replacement cost.In the case of a total loss, where the entire house and its contents are damaged beyond repair, insurers generally pay the policy limits, according to the laws in your state. That means you can receive a check for what the home and contents were insured for at the time of the disaster. Next steps: We can't reinforce it enough - claims are easier to make when you have a home inventory ready!

India’s deadliest plane crash in more than decade is set to send shock waves through the aviation insurance industry and trigger one of the country’s costliest claims, estimated at around $475 million.

Claims processing is one of the most crucial components of insurance. This article addresses the top 7 technologies that insurers can enhance claim processing.

Some insurance companies are also already using AuT for the initial claim investigation. The intelligent drones, which are equipped with computer vision models, examine the insured object—especially after natural disasters.This tech is still new, but it’s expected to grow quickly by 2030.(https://www.mckinsey.com/industries/financial-services/our-insights/claims-2030-dream-or-reality) Advanced analytics use smart algorithms to find patterns and make predictions. These tools help with: ... Insurers use data from reports, photos, and customer behavior (like browsing or location history).This helps companies save time and assign staff to more complex tasks. With no-code or low-code tools, insurers can build apps quickly, without hiring many developers. Claims processing is one of the most important parts of the insurance business.Nearly 70% of an insurance company’s expenses come from handling claims.(https://www2.deloitte.com/us/en/insights/industry/financial-services/insurance-claims-transformation.html) Effective claims handling is linked to effective insurance fraud detection and prevention, as most of the fraud types like hard fraud or double dipping fraud occur at the claims processing related times.

Experienced bad faith from an insurance company? Call the Law Offices of David H. Schwartz, INC. for representation in insurance coverage disputes.

Insurance is meant to provide a safety net, but disputes can arise when insurance companies fail to honor legitimate claims. These situations often involve allegations of bad faith, where an insurer acts dishonestly or unreasonably in denying or delaying coverage.Bad faith in insurance occurs when an insurance company does not honor its legal or contractual obligations to a policyholder. This could mean denying a claim without a valid reason, delaying payment unnecessarily, or failing to thoroughly investigate a claim.California law holds insurers to a high standard of conduct, requiring them to deal fairly with policyholders and fulfill their contractual obligations in a timely manner. When an insurer acts otherwise, the policyholder can seek legal recourse. Filing a bad faith claim involves proving the insurer acted unreasonably or dishonestly in handling the case.Requesting excessive documentation: Repeatedly asking for unnecessary or duplicate documents to stall the claims process. · If you or someone you know has experienced any of these behaviors from an insurance company, it could be a sign that your insurer is failing to act in good faith.

The Maharashtra government has decided to blacklist farmers found submitting fake crop insurance claims, an action largely limited to intermediaries and service providers earlier, a senior official from the state agriculture department said.

The Maharashtra government has decided to blacklist farmers found submitting fake crop insurance claims, an action largely limited to intermediaries and service providers earlier, a senior official from the state agriculture department said on Sunday.The decision comes in the wake of multiple instances where fraudulent applications were filed under the crop insurance programme, the official said. "The Maharashtra government has now decided to even blacklist farmers if they are found submitting bogus claims to get undue benefits of crop insurance.Once blacklisted, a farmer might not be able to file claims for at least a few years, he said. The government has already taken legal action against several Common Service Centres (CSCs) across the state for allegedly filing nearly 4,400 fake crop insurance applications for the 2024 Kharif season.As per the government policy, farmers can file insurance claims for losses due to reasons like excess or deficient rainfall, pest infestation or challenges in sowing due to natural phenomena.

Tips to help you file a home or auto insurance claim.

Consider your deductible—how much you pay before your insurance pays. If you make a claim, write down details including when you called the company, who you talked to, and your adjuster’s name.Also photograph the other driver’s insurance information, driver’s license, and license plate. If your house is damaged, write down the time and date you first saw the damage. Also note what the weather was like at the time. Take photos of any damage. Protect your home from further damage by covering broken windows or putting a tarp over a roof hole. Don’t make permanent repairs until your company gives the OK. On any claim, save all receipts.After a car accident or incident at your home, talk to your insurance company. You’ll want to discuss your options. Maybe you don’t want to file a claim.Want more tips about making a claim? Listen to this Texas Insurance Podcast.

US insurers paid $1.04 billion in lightning-related homeowners’ insurance claims in 2024, according to the Insurance Information Institute, or Triple-I.

The number of claims also declined sharply. Insurers reported 55,537 lightning-related claims in 2024, down 21.5% from 70,787 the previous year. This marks the lowest total recorded since before 2017.“Lightning remains a costly and unpredictable threat, with ground surges causing nearly half of all claims,” said Michal Brower of State Farm. “These events can damage electrical systems, appliances, and building infrastructure. The data highlights the importance of preparedness, particularly in high-frequency lightning areas.” · State Farm, which reported $31.46 billion in direct homeowners premiums written in 2024, remains the largest writer of homeowners’ insurance in the US.Figure represents a 16.5% decrease from a year earlierOver a longer timeframe, the data show a shift in the nature of lightning-related losses. Between 2017 and 2024, the number of claims declined by 34.7%, while the average cost per claim rose nearly 73%, reflecting factors such as rising repair costs and increased use of electronic devices in homes.

This season’s storms and hurricanes unleased unprecedented carnage on numerous communities throughout the summer and fall. In addition to the absolutely tragic human toll, commercial and individual insurance claims are at heightened levels due to the catastrophic damage to cities, towns and ...

This season’s storms and hurricanes unleased unprecedented carnage on numerous communities throughout the summer and fall. In addition to the absolutely tragic human toll, commercial and individual insurance claims are at heightened levels due to the catastrophic damage to cities, towns and rural areas (whether coastal or inland).The bad news is that insurance policy fine print can greatly impede recoveries. A case in point is the recent Fifth Circuit court decision in which the appellate court ruled against a policyholder’s hurricane damage claim because it was found to be time-barred under the “the one-year limit for claims under the Standard Flood Insurance Policy” (Mt.The reality, however, is that for many policyholders the claims process is a long, protracted system of repeated insurance company requests for information, amendments to proof of loss forms, claim negotiations, and insurance company delays in funding insurance claims in full.Thus, if the normal statute of limitations applicable to an insurance dispute would be 3, 4, 5 or even 6 years (like New York), these insurance policy suit limitation clauses purport to drastically slice that time period down. Accordingly, a policyholder may not have even close to all the time it needs to file suit should a claim dispute arise or claim payments remain outstanding as a deadline nears.

California Insurance Commissioner Lara Appoints Members to New Smoke Claims and Remediation Task Force - Task Force to Develop Statewide Smoke Remediation Standards to Provide Clear Guidance After Wildfire Catastrophes

July 6, 2025 - LOS ANGELES - In response to the smoke damage caused by wildfires across California, including the recent Palisades and Eaton fires, Insurance Commissioner Ricardo Lara has appointed members to his new Smoke Claims and Remediation Task Force.Without clear statewide protocols, many consumers report having their claims denied without thorough investigation or being compelled to return to homes they feel are unsafe, especially as smoke impacts extend beyond the immediate fire areas to downwind neighborhoods. Moreover, the Department is currently investigating hundreds of smoke damage-related complaints from wildfire survivors concerning various insurance companies and the California FAIR Plan.It is scrutinizing State Farm’s handling of thousands of claims from wildfire survivors impacted by the Palisades and Eaton wildfires, with a particular focus on smoke damage. Commissioner Lara is also working with the National Association of Insurance Commissioners to engage with other insurance regulators facing similar smoke damage challenges in their states.The group also plans to receive presentations from wildfire survivor groups, fire safety experts, public health specialists, and insurance industry representatives. The Task Force is one of several initiatives Commissioner Lara is undertaking to ensure that wildfire claims are handled fairly and comprehensively.

An insurance claim is the first step toward financial relief for a person with insurance coverage. Read on to learn how it works and the different types of claims people file.

However, in the majority of cases, only the person(s) listed on the policy is entitled to claim payments. Insurance claims protect policyholders from financial loss.The most common insurance claims involve costs for medical goods and services, physical damage, loss of life, liability for the ownership of dwellings (homeowners, landlords, and renters), and liability resulting from the operation of automobiles.For property and casualty insurance policies, regardless of the scope of an accident or who was at fault, the number of insurance claims you file has a direct impact on the rate you pay to gain coverage (typically through installment payments called insurance premiums).The greater the number of claims that are filed by a policyholder, the greater the likelihood of a rate hike. In some cases, it's possible if you file too many claims that the insurance company may decide to deny you coverage.

:max_bytes(150000):strip_icc()/insurance_claim.asp-final-ad2bc2c60d5c46e999bf064a90ff2dc6.png)

The litigation claims that the collusion and boycott were carried out through meetings of the FAIR Plan’s governing committee and subcommittees, as well as weekly meetings of the Personal Insurance Federation of California and the American Property Casualty Insurance Assn., or APCIA, two ...

The litigation claims that the collusion and boycott were carried out through meetings of the FAIR Plan’s governing committee and subcommittees, as well as weekly meetings of the Personal Insurance Federation of California and the American Property Casualty Insurance Assn., or APCIA, two leading trade groups, among other mechanisms.A couple whose home was damaged in the Palisades fire filed a lawsuit Monday against the California FAIR Plan, the state’s home insurer of last resort, seeking to force the insurer to turn over claims documents.Two Los Angeles County Superior Court lawsuits accuse dozens of California home insurers of dropping policyholders and forcing them onto the FAIR Plan — the state's insurer of last resort — where polices cover less and cost more.The firestorms that swept through Pacific Palisades, Altadena and other communities Jan. 7 not only devastated thousands of homeowners but highlighted a giant problem: the growth of the state’s insurer of last resort. The California FAIR Plan Assn.

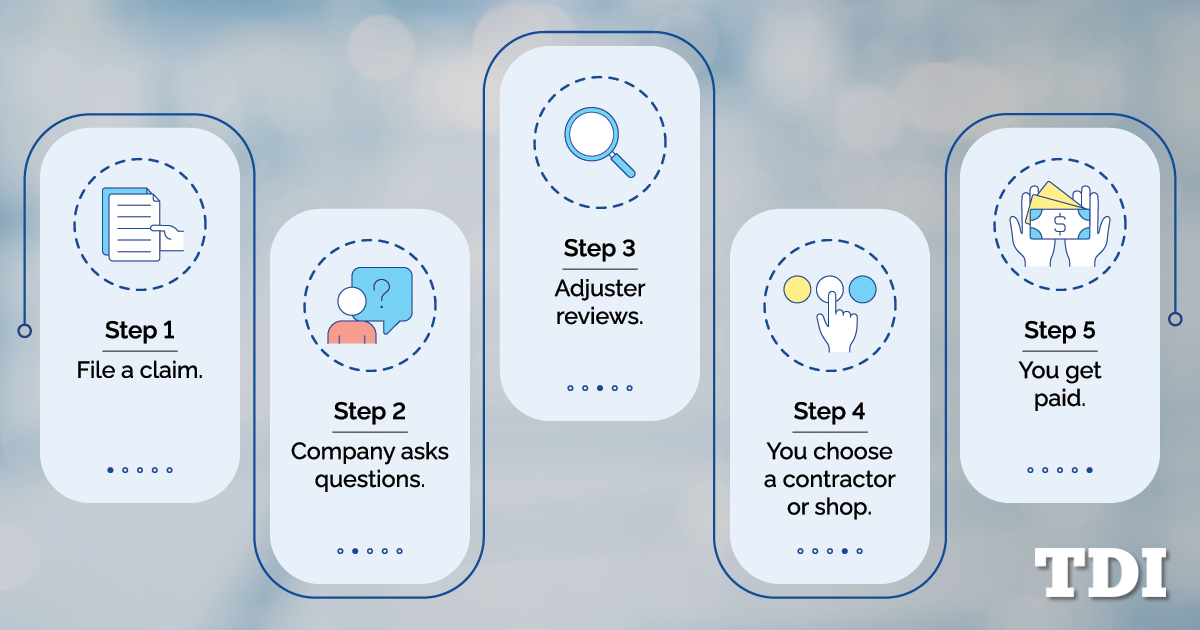

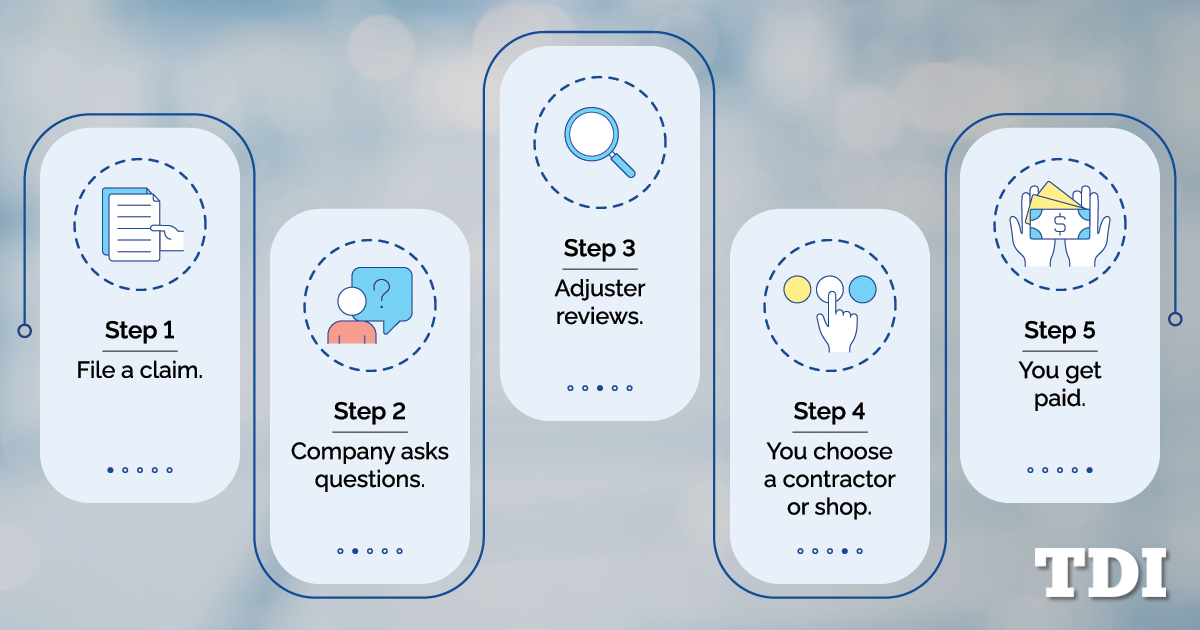

Steps to help you understand the claims process for home and auto insurance claims.

File a claim as soon as you can. This could be with your insurance company or someone else’s insurance company. If it’s someone else’s insurance company, still let your insurance company know about the accident.Deadline: Your company has 15 business days to say it got your claim. The company must also start its review and ask you for any information it needs. Your insurance company will look at your policy to see if it covers the type of damage you had. An adjuster might visit in person or look at pictures of the damage to estimate repair costs.If the company rejects your claim, it must say why in writing. The company can extend this deadline by 45 days if they tell you why they need more time. Note: TDI can extend these deadlines by 15 more days if there is a weather-related catastrophe. Your insurance company might give you a list of body shops, but you can take your car to any shop.The insurance company will subtract your deductible from your payment if you used your own insurance. You will owe that deductible to the contractor or body shop. For home claims, you might get two payments if you have replacement cost coverage. The first payment is for the estimated repair costs minus depreciation.

U.S. insurers paid $1.04 billion in lightning-related homeowners insurance claims in 2024, marking a 16.5% decrease from the $1.24 billion paid in 2023,

U.S. insurers paid $1.04 billion in lightning-related homeowners insurance claims in 2024, marking a 16.5% decrease from the $1.24 billion paid in 2023, according to the Insurance Information Institute (Triple-I).However, Texas reported the highest average cost per claim at $38,558, compared to Florida’s $23,686. The national average stood at $18,641. Damage from lightning, including fire, is typically covered under standard homeowners, condo, renters, and business insurance policies.More than half of all claims came from the top 10 states, with Florida, Texas, and California leading the nation.Michal Brower of State Farm, said, “Lightning remains a costly and unpredictable threat, with ground surges causing nearly half of all claims.

This post is part of a series sponsored by Cotality. Crime thrives in chaos, making natural disasters the perfect backdrop for insurance claims fraud.

When the ashes have settled after a wildfire or when hail stops falling and flood waters recede after back-to-back severe storms, it is convenient — tempting, even — for some homeowners to submit exaggerated or downright fabricated insurance claims.According to the National Insurance Crimes Bureau, fraud accounts for 10 percent of the claims paid out following disasters. In total, fraud costs insurers, and indirectly policyholders, $45 billion annually. And it’s getting worse.Perpetrators often view claims fraud as a victimless crime. They assume a few small lies are worth telling, so they can secure payment for damage that didn’t occur when they say it did. Perhaps they figure that there’s no way for an insurer to tell that hail struck their roof before they actually had coverage.For instance, there was no way for any insurer to prevent any of the natural disasters that paralyzed U.S. regions in recent years. Fraud, however, is a different story. Claims deception is a major driver of the insurance crisis, and one that individual companies can address immediately.

Wildfire devastation can be overwhelming but you don’t have to tackle it alone. Learn more about insurance claims and financial assistance.

Renters insurance doesn’t cover damage to your rental; that’s the landlord’s responsibility. But your policy will likely cover the cost of lost belongings and temporary housing. Collect business records you’ll need to complete your claim, including documents that prove the value of damaged inventory, equipment or structures.Experts say there can be so much information out there on what financial assistance to apply for, how to file insurance claims or where to find temporary housing that it can become information overload.Filing an insurance claim can be a lengthy process.An adjuster will then investigate your claim to determine whether the insurance company is liable and how much to pay out.

We cannot provide a description for this page right now

Bupa says it processes millions of hospital and medical claims each year and the overwhelming majority are assessed and paid without issue. abc.net.au/news/bupa-private-health-insurance-customers-denied-claims/105484650Link copied

Health insurer Bupa has been accused of ongoing unscrupulous behaviour towards its customers amid legal action by the competition watchdog. ABC News has been contacted by patients and medical practices from around the country concerned legitimate claims have been denied.Bupa rejected claims in full when only part of a procedure was not covered. The insurer admitted to engaging in misleading or deceptive conduct.She said Bupa tried to reject a claim for laparoscopic surgery to investigate possible ovarian cancer when she went through the pre-surgery eligibility check. The mother-of-two had bronze-level cover that included cover for gynaecological surgery. But because one part of the procedure was deemed "digestive" by the insurer and the government, the claim was initially rejected in full.Bupa is Australia's second-largest private health insurer. Figures from the Commonwealth Ombudsman show 2024 complaint numbers were largely in proportion to its market share. Queensland man David Anderson said he was left with a $48,000 bill for triple bypass heart surgery in 2022 after Bupa denied his claim.

:max_bytes(150000):strip_icc()/insurance_claim.asp-final-ad2bc2c60d5c46e999bf064a90ff2dc6.png)